Insurance Agent Job Description for Dummies

Wiki Article

All about Insurance Advisor

Table of ContentsThe Ultimate Guide To InsuranceThe Greatest Guide To Insurance Asia AwardsHow Insurance Account can Save You Time, Stress, and Money.How Insurance Ads can Save You Time, Stress, and Money.Some Known Facts About Insurance Commission.The Buzz on Insurance Agent Job Description

Although buying an insurance coverage that satisfies your state's needs may allow you to drive without damaging the legislation, reduced protection limits do not supply enough protection from a financial viewpoint. Many states just require drivers to have obligation insurance policy, for instance. This implies that in the instance of a mishap, motorists can sustain 10s of thousands of bucks of damage that they can't cover on their very own, in some cases also leading to financial destroy.

To conserve cash, you can pick a higher deductible for your crash and comprehensive protection. Also though that's a lot of money to pay in an at-fault mishap, it's still much less pricey than changing a person's totaled BMW.

Insurance Account Things To Know Before You Get This

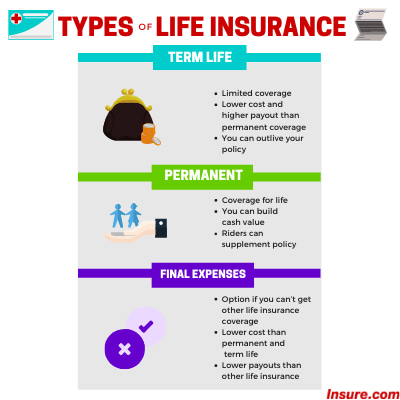

Vehicle Insurance Claims Contentment Research, SM. What's even more, USAA often tends to have the most inexpensive complete insurance coverage insurance policy policies out of every service provider that we evaluated, showing that first-class coverage need not come with a costs. USAA automobile insurance coverage is just offered for military participants as well as their families, so most vehicle drivers will not be able to take advantage of USAA insurance protection.What kind of life insurance policy is best for you? That depends upon a selection of elements, consisting of how much time you want the plan to last, just how much you intend to pay and whether you wish to utilize the policy as an investment vehicle. Various kinds of life insurance, Common kinds of life insurance policy include: Universal life insurance policy.

Guaranteed concern life insurance policy. All kinds of life insurance coverage loss under two primary classifications: Term life insurance coverage. These plans last for a details number of years and also are suitable for many insurance act people. If you don't pass away within the time frame defined in your policy, it runs out with no payout. Long-term life insurance.

Little Known Questions About Insurance Agent Job Description.

Common sorts of life insurance coverage plans, Simplified issue life insurance policy, Ensured issue life insurance policy, Term life insurance, Just how it functions: Term life insurance policy is normally sold in sizes of one, 5, insurance expense 10, 15, 20, 25 or three decades. Insurance coverage amounts differ relying on the policy but can go into the millions.

There's typically little to no money value within the policy, and also insurers demand on-time payments. You can pick the age to which you desire the death advantage guaranteed, such as 95 or 100. Pros: Because of the marginal cash worth, it's cheaper than entire life and various other kinds of universal life insurance coverage.

The smart Trick of Insurance Commission That Nobody is Discussing

And also given that there's no money worth in the policy, you 'd stroll away with absolutely nothing. Your gains are determined by a formula, which is laid out in the policy.The finest life insurance coverage policy for you comes down to your needs and budget. With term life insurance and and also entire insurance, premiums costs generally fixedDealt with which means indicates'll pay the same amount quantity month. Health and wellness insurance and also vehicle insurance policy are required, while life insurance policy, home owners, tenants, and impairment insurance are motivated.

See This Report about Insurance Commission

Below, we have actually described briefly which insurance protection you must strongly consider acquiring at every stage of life. Once you exit the working world around age 65, which is frequently the end of the longest plan you can buy. The longer you wait to acquire a plan, the better the ultimate cost.The best life insurance coverage policy for you comes down to your demands and spending plan. With term life insurance insurance coverage and also life insuranceInsurance coverage premiums typically are fixedDealt with which means implies'll pay the same very same every month. Wellness insurance coverage as well as auto insurance policy are required, while life insurance, property owners, occupants, and handicap insurance coverage are encouraged.

Insurance Agent Job Description Things To Know Before You Buy

Below, we've explained briefly which insurance policy coverage you must highly think about buying at every stage of life. As soon as you exit the functioning world around age 65, which is often the end of the lengthiest plan you can purchase. The longer you wait to acquire a policy, the better the ultimate expense.Report this wiki page